.png)

|

>> QR Codes: Check in everywhere, every time

Checking in is still important and is required everywhere, every time.

Businesses, venues and facilities with electronic record keeping requirements must use the Victorian Government QR Code Service to check-in customers, workers and visitors.

>> Check your vaccination requirements

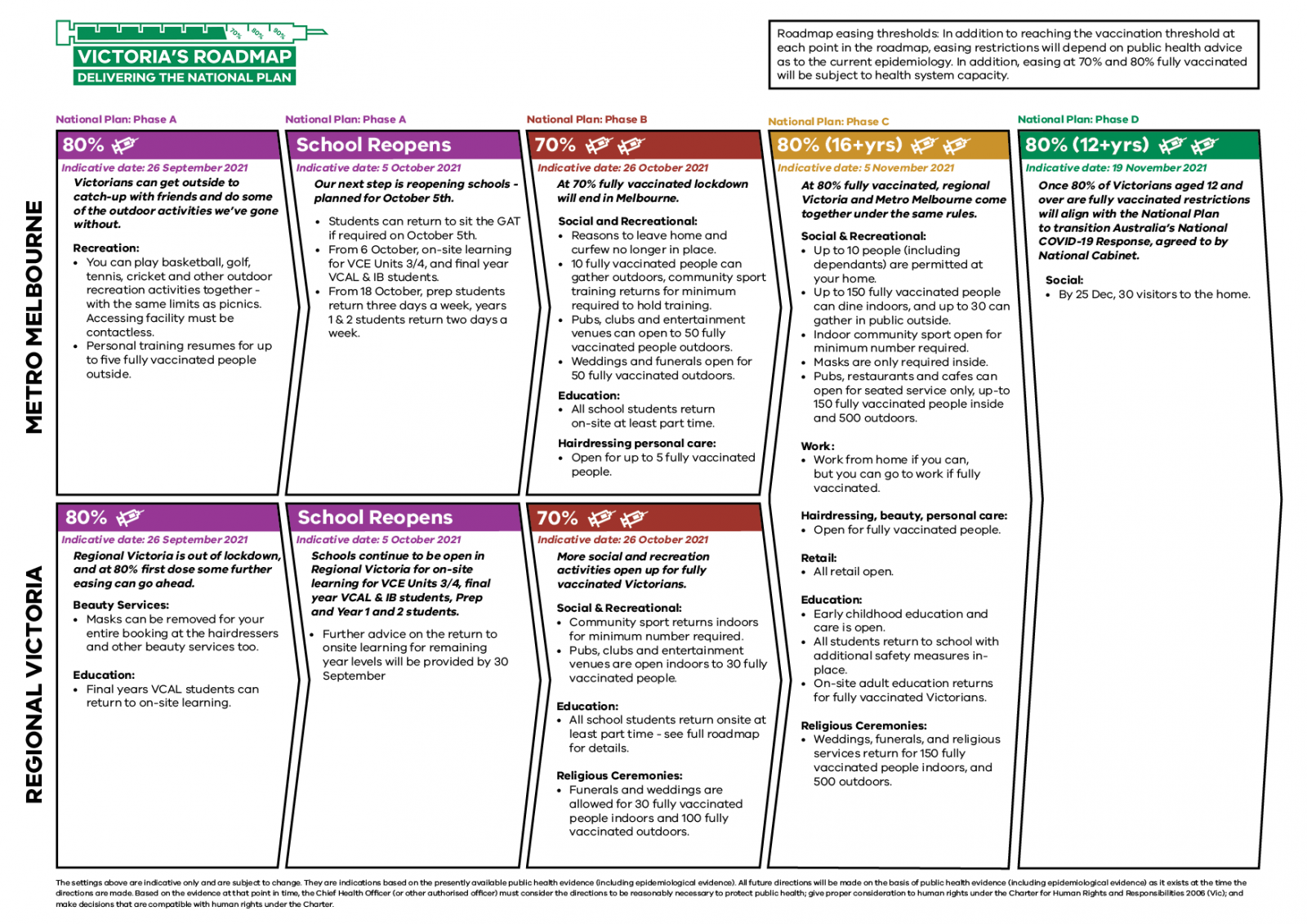

All businesses are urged to review their employee vaccination requirements against Victoria’s Roadmap. The Roadmap provides for a progressive reopening with eased capacity limits across various settings when all attendees are fully vaccinated. This includes workers.

The option of eased capacity limits will only apply if everyone present is fully vaccinated (or has a valid medical exemption). This means if your staff are not fully vaccinated, you may not be able to open or to apply the eased capacity limits offered in the Roadmap. Encourage your workers to get vaccinated as soon as possible.

>> Update your COVIDSafe Plan

Every business in Victoria with on-site operations is required to have a COVIDSafe Plan - it is a documented list of safety actions. There are resources and templates available to help you develop and update your COVIDSafe Plan, so it meets the latest requirements and health advice.

>> Staying COVIDSafe

It’s important that your business is COVIDSafe and follows the COVIDSafe principles.

You and your workers must wear a face mask indoors and outdoors – unless you have a lawful exception. This includes people who are fully vaccinated.

The Coronavirus website has information specific to each sector and industry to help you adhere to COVIDSafe practises.

GUIDES & POSTERS

Guides & Templates

- Check vaccination status of customers

- Check vaccination status of workers

- Customers without a smart phone

- How to deal with difficult customers

- Proof of vaccination status

- Tips for talking to customers

Posters & Flyers

- Density limit

- Face mask must be worn

- Face masks ID check

- Physical distancing

- Regional ID check

- Respect our staff

- Vaccination status required

- Vaccination status required (steps)

- Acceptable proof of your vaccination

HANDLING DIFFICULT CUSTOMERS

Some people feel strongly about COVID-19 rules.

If customers are aggressive or intimidating, your safety and the safety of your workers is the top priority.

Please don't put yourself in harms way, some tips that might be helpful to remind your teams.

DO...

- Stay calm and speak in a clear voice

- Listen to the customer and be patient

- Nominate someone (such as the manager on site) to handle complaints

Then the nominated person can:

- Remind the customer that the rules have been put in place so you can safely reopen, and you must follow them or risk being shut down

- Explain that they must comply or leave the premises

- Ask for help — call in colleagues and managers to assist

- Alert security or contact Victoria Police if the situation escalates

- Retreat to a safe location if you feel threatened

DON'T...

- Argue — try to contain and limit any hostility

- Raise your voice — even if the customer is yelling at you, don’t yell back

- Put your safety at risk — go to a safe place if you need to

Download How to Deal with Difficult Customers PDF

Handling Difficult Customers

(5 minutes) Watch Video Here...

You are an Exposure Site - What to do??

(30 minutes) Watch Video Here...

Mandatory Vaccination for Authorised Workers

(40 minutes) Watch Video Here...

*Updates & recources for the attached information session can be found here

Postcode, suburb and address checker

Enter a postcode, suburb or address to identify whether it belongs to an area with lockdown restrictions.

See the Postcode, suburb and address checker

VTIC - REOPENING SERIES: CUSTOMER AGGRESSION MANAGEMENT TRAINING

Delivered by Victorian Tourism Industry Council

Date: Tuesday 26 October

Time: 11am - 1pm

How best to prevent, be proactive, and deal with aggressive and hostile visitors.

This webinar will deliver learning modules that will cover guidelines, techniques and tools for managing aggressive customers, situational awareness and immediate response.

More Information & Register...

BACK TO THE FUTURE: MANAGING THE WORKPLACE TRANSITION POST-PANDEMIC

Source: Black dog institute

As businesses and managers across the country navigate the different stages of reopening after being adrift for so long, the readjustment as people return to the workplace post-pandemic is likely to be complex.

With some workers spending the best part of two years working from home, many may be reluctant to return to the physical office, while others may seek a more permanent flexible approach to their working from home arrangements.

Some staff may be feeling anxious following the lack of social contact and prefer to take it slowly, while others may be worried about their health or have concerns surrounding the vaccination status of their colleagues or customers they interact with.

Public transport, the amount of office or workspace available and the assimilation of teams who may never have met each other face-to-face are all things managers need to consider as they work out how to best support their staff.

So how can managers smooth the way and support their employees through this transition?

Read Full Article...

Updates for Mandatory Vaccination for Authorised Workers Information Session

- Update from James Remington in relation to standing down employees who have not met the requirements to be vaccinated:

"When I checked after the authorised worker mandate was first announced by the Premier a couple of weeks ago, the Fair Work Ombudsman’s position was that it was doubtful stand down would be available where an employee could not work because of non-compliance with the vaccination mandate. Evidently the Ombudsman has revised its position, which is a good thing for businesses. It means termination of employment will not be the only option available where someone who is subject to the mandate and cannot work from home refuses to be vaccinated.

It’s important to bear in mind that the Ombudsman does not make law; rather, it is an enforcement and advisory body. However, employers who follow its advice in good faith are much less likely to be faced with pecuniary penalties if a court ultimately rules in a manner contrary to the Ombudsman’s advice"

- COVID-19 Mandatory Vaccination (Workers) Directions – these are the actual rules which were issued 8.10.21: https://www.dhhs.vic.gov.au/sites/default/files/documents/202110/covid-19-mandatory-vaccination-%28workers%29-directions.pdf

- Fair Work Ombudsman guidance:

https://coronavirus.fairwork.gov.au/coronavirus-and-australian-workplace-laws/covid-19-vaccinations-and-the-workplace/covid-19-vaccinations-workplace-rights-and-obligations

https://coronavirus.fairwork.gov.au/coronavirus-and-australian-workplace-laws/covid-19-vaccinations-and-the-workplace/covid-19-vaccinations-legislation-and-public-health-orders - Office of the Australian Information Commissioner guidance on privacy and vaccination issues: https://www.oaic.gov.au/privacy/guidance-and-advice/coronavirus-covid-19-understanding-your-privacy-obligations-to-your-staff

.png)

.png)

.png)

.png)

.png)

(1).png)

.png)